National Pension System (NPS) is a retirement benefit Scheme introduced by the Government of India to facilitate a regular income post retirement to all the subscribers. PFRDA (Pension Fund Regulatory and Development Authority) is the governing body for NPS.

National Pension System (NPS) is based on unique Permanent Retirement Account Number (PRAN) which is allotted to every subscriber. In order to encourage savings, the Government of India has made the scheme reassuring from security point of view and has offered some attractive benefits for. NPS account holders

An NPS Account offers the following benefits:

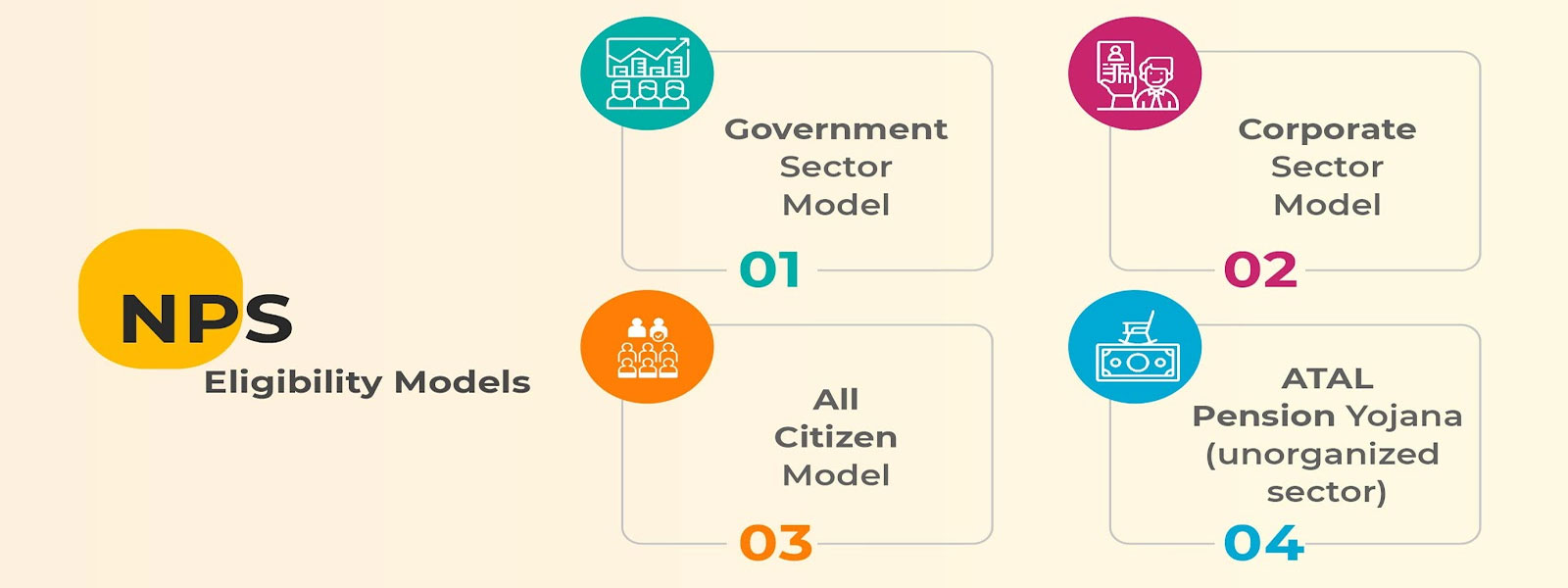

Any Indian citizen aged between 18 and 65 can open an NPS account, including salaried individuals, self-employed persons, and NRIs.

NPS offers two types of accounts: Tier I (mandatory and intended for retirement) and Tier II (voluntary and more flexible, allowing withdrawals).

Contributions to NPS are eligible for tax deductions under Section 80C (up to ₹1.5 lakh) and an additional deduction of up to ₹50,000 under Section 80CCD(1B).

Subscribers can select their asset allocation among equity, corporate bonds, and government securities, or opt for a lifecycle fund that automatically adjusts the allocation based on age.

You can make partial withdrawals under specific conditions (after 3 years of investment) and, upon retirement, withdraw up to 60% of the corpus as a lump sum, while the remaining 40% must be used to buy an annuity.